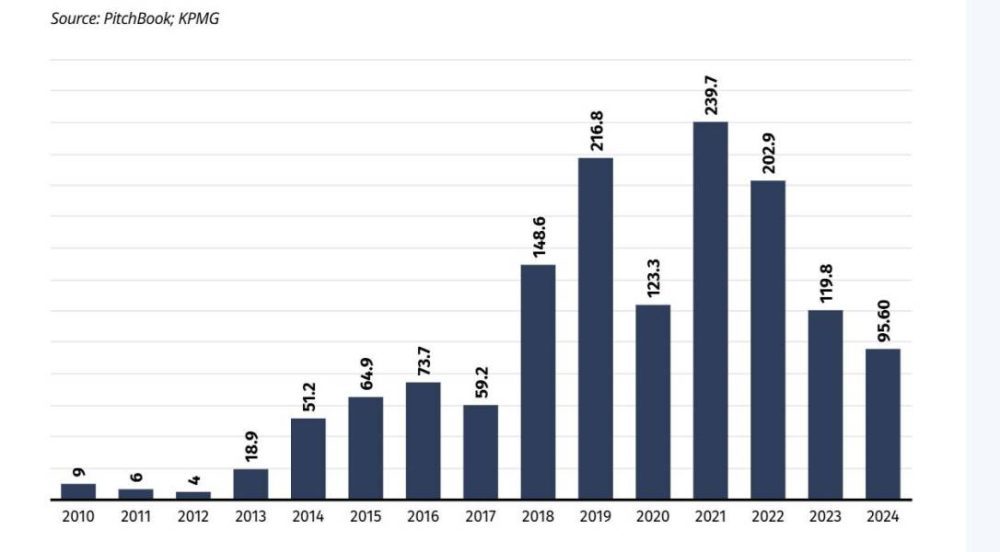

Global fintech investments fell to $95.6 billion in 2024, marking a 60% decline over three years and the lowest level in seven years. While overall funding dropped, the payments sector doubled its investments to $31 billion. The Americas led with $63.8 billion, followed by EMEA ($20.3B) and ASPAC ($11.4B).

The fintech industry, which has attracted $1.4 trillion in investments since 2010, is currently experiencing a significant decline in funding. In 2024, global fintech investments totalled $95.6 billion, representing a sharp 60% decline from their peak three years ago. This downturn marks the lowest level of investment in the sector since 2017, highlighting a significant shift in investor sentiment.

Data from the KPMG Pulse of Fintech report shows that fintech funding has been declining consistently for the past three years. After reaching an all-time high of nearly $240 billion in 2021, investment volumes fell to $119 billion in 2023 and continued their downward trend in 2024.

Several factors have contributed to this decline, including economic uncertainty, geopolitical instability, and shifting investment priorities. Despite the overall drop, certain segments within fintech have shown resilience, with the payments sector defying market trends and experiencing substantial growth in investment.

Steady decline in global fintech investment over three years

The financial services sector has undergone rapid digital transformation in recent years, driven by advancements in cryptocurrencies, blockchain, digital payments, crowdfunding, and robo-advisory services. These innovations led to record levels of investment between 2019 and 2021, with an annual average of $200 billion flowing into the industry.

However, investment enthusiasm began to wane in 2022, leading to a steady decline in funding. By 2023, fintech investment had dropped to $119 billion, making it the second-largest decline since the COVID-19 pandemic. This trend continued into 2024, as macroeconomic uncertainty and high-profile elections further dampened investor confidence.

The declining investment levels have also had a direct impact on new fintech startups. In 2024, only 479 new fintech companies entered the market, a 56% decrease from the previous year and the lowest figure recorded in the past 15 years.

Payments sector shows strong growth amid market slowdown

Despite the general downturn in fintech investments, the payments sector has demonstrated strong growth. Investment in this segment doubled in 2024, rising from $17.2 billion in 2023 to $31 billion in 2024. This significant increase highlights the continued demand for digital payment solutions, particularly in the B2B payments sector.

The adoption of real-time payments, mobile point-of-sale systems, and cross-border payment solutions has played a key role in driving investor interest. The resilience of the payments sector indicates that investors still see strong potential in certain areas of fintech, despite the overall slowdown.

Investment distribution by region

The Americas continued to dominate global fintech investment in 2024, securing $63.8 billion across approximately 2,200 deals. The United States remained the largest market, attracting $50.7 billion in funding across 1,800 deals.

In comparison, the Europe, Middle East, and Africa (EMEA) region recorded $20.3 billion in fintech investments, while the Asia-Pacific (ASPAC) region followed with $11.4 billion. The disparity in investment levels highlights the concentration of fintech funding in North America, particularly in the United States.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.